MERSCORP Holdings, Inc. is a privately held corporation that owns and manages the MERS® System and all other MERS® products. It is a member-based organization made up of more than 5,000 lenders, servicers, sub-servicers, investors and government institutions.

Homeowners Frequently Asked Questions

What is MERSCORP Holdings?

What is MERS?

MERSCORP Holdings, Inc. is a subsidiary of Intercontinental Exchange (NYSE: ICE) and operates the MERS® System, MERS® eRegistry and all other MERS® products and services. The MERS® System is a national electronic database that tracks changes in mortgage servicing and beneficial ownership interests in residential mortgage loans on behalf of its members. The MERS® eRegistry is the system of record for identifying the Controller (holder) and Location (custodian) for the authoritative copy of an eNote.

What is the MERS® System?

The MERS® System is a national electronic database that tracks changes in mortgage servicing rights and beneficial ownership interests in loans secured by residential real estate.

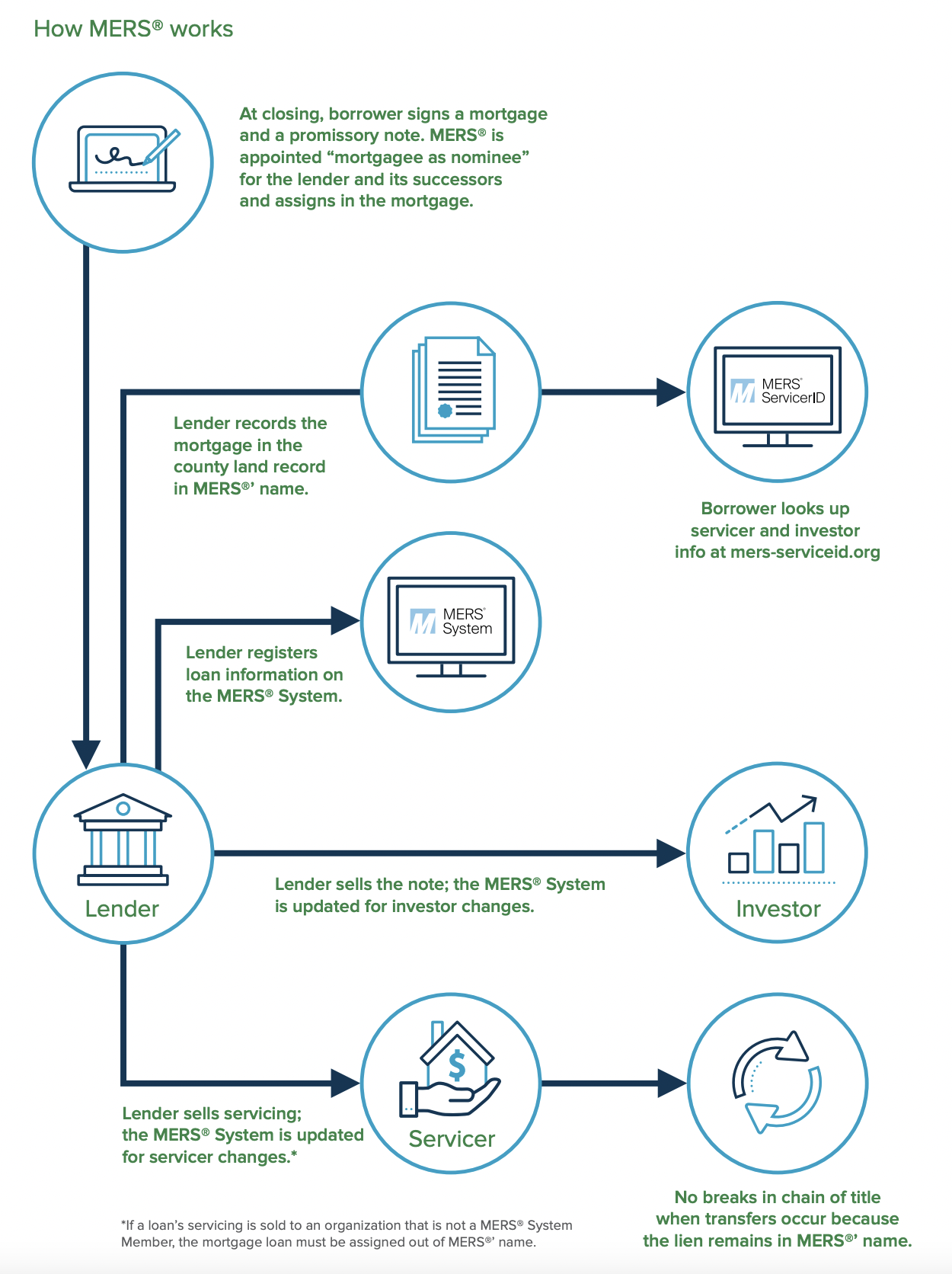

How does MERS work?

What is a servicer?

The servicer is YOUR mortgage company. It is the company that handles the day-to-day tasks associated with managing your loan. Their duties include but are not limited to:

- Collecting and remitting loan payments

- Responding to borrower inquiries

- Making advances when required

- Accounting for principal and interest

- Holding funds for payment of property taxes and hazard insurance (also called managing your escrow account)

- Making any physical inspections of the property

- Counseling delinquent mortgagors

- Supervising foreclosures and property dispositions in case of defaults

How can I find out the identity of my servicer?

We can help! MERS® ServicerID is a free service we provide to connect you with the current servicer of your loan, if it is registered in the MERS® System. You may access it by:

- Dialing the toll-free number at (888) 679-6377, or

- Clicking here for online access

Can you help me identify the owner or investor of my mortgage loan?

MERS® ServicerID can help. Dial the toll-free number at (888) 679-6377 or click here for online access.

What information do I need to provide?

You can search for servicer information in three ways: by property address, the borrower’s name and social security number, or with the unique mortgage identification number (MIN) on the mortgage or deed of trust signed at closing. Don’t worry if you don’t know it — it’s not required. But to obtain investor (owner) information, you will be asked to verify certain identifying information and check the box that confirms you are the borrower or the borrower’s authorized representative.

Why do I need to know the identity of my servicer?

There are three reasons why you must always keep track of the identity of your servicer:

- Your servicer is responsible for handling any questions you have about your mortgage loan. Payoff amount? Contact your servicer. Taxes and hazard insurance? They should have that information too. Check your payment booklet or your monthly statement. Do you see a toll-free number you can call or a website you can access?

- Your servicer is also responsible for collecting your payment. To avoid late fees and potential fraud, make sure you are sending your payment to the correct servicer.

- If you are unable to make the payments on your mortgage and wish to negotiate the terms of your loan, you may only do so with your servicer. Contrary to popular belief, it is your servicer and not the investor that can negotiate the terms of the loan with you.

Where can I get more information on my loan or the basics of obtaining a mortgage?

For more information and assistance on your mortgage loan, please visit one of the following websites:

- Hope Now. An alliance between counselors, servicers, investors and other mortgage industry participants to assist distressed homeowners.

- Home Loan Learning Center. Sponsored by the Mortgage Bankers Association. Educates consumers on the basics of obtaining a mortgage. Also includes a link to its Foreclosure Prevention Resource Center.

- Neighborworks America. A national nonprofit organization created by Congress to provide financial support, technical assistance, and training for community-based revitalization efforts.

- Information on foreclosure rescue scams, published by the Federal Trade Commission.